salt tax cap new york

Property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000 of state and local taxes paid in addition to a 12000. The bill would boost the.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Enacted through the Republicans 2017 tax overhaul the SALT cap has been a pain point for costly states like New York and New Jersey because residents cant deduct more than 10000 in state and.

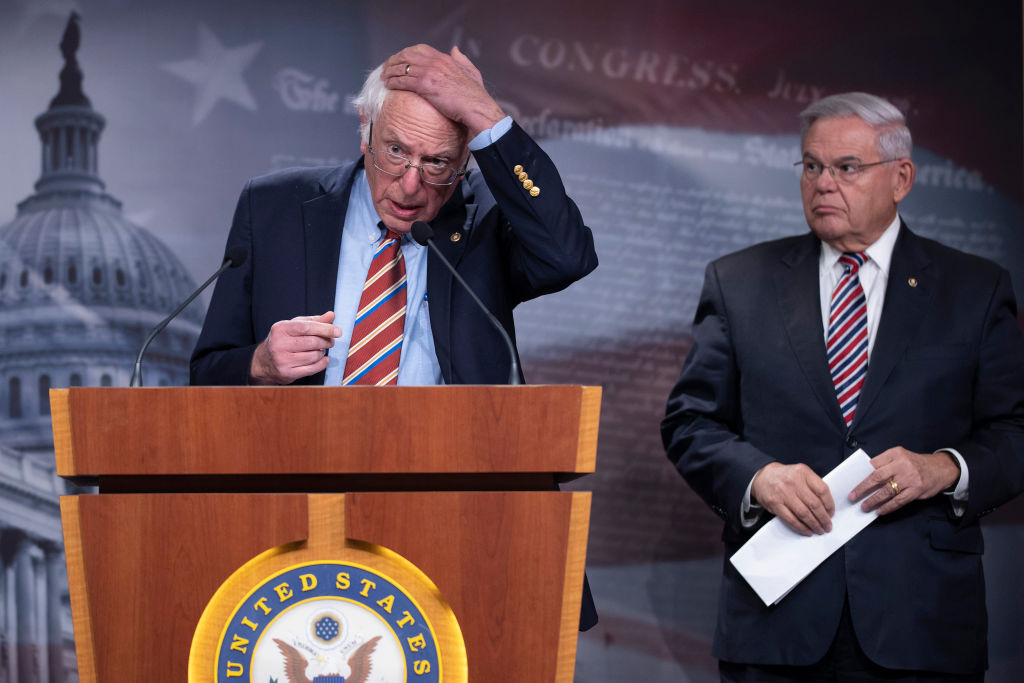

. Instead he proposed a two-year extension of an existing tax limit on deductions for. Although during the Trump administration it challenged a SALT cap workaround for individual. Bob Menendez indicated that he plans to vote for a multi-billion dollar climate and health care package even if it does not expand the so-called SALT deduction.

House members in higher tax states especially have proposed raising the SALT cap to 80000. New York State is expanding a tax break that allows smaller companies to circumvent the 10000 limit on state and local tax deductions from the 2017 Tax Cuts and Jobs Act similar to a workaround also being permitted in some other high-tax states. Scott is a New York attorney with extensive experience in tax corporate financial and nonprofit law and public policy.

The decline from 2016 to 2018 was driven by the SALT deduction cap and to a lesser extent the drop in itemization due to the doubling of the standard deduction. But undid the extension of the so-called SALT cap. Democrats from high-tax blue states are insisting on the repeal of a rule that limits state and local tax SALT deductions to 10000 which was.

The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. Starting with the 2018 tax year the maximum SALT deduction available was 10000. Tom Suozzis defense of uncapping the 10000 state-and-local-tax deduction is all wrong Letters Aug.

Note that as part of ongoing discussions in Congress around the framework of President Bidens Build Back Better plan some Democrats have proposed increasing the SALT deduction cap from 10000 to 80000. Those eager to see a cap lifted on a federal write-off for state and local taxes were dealt a blow Wednesday when US. Then the sand.

Why the SALT Deduction. A handful of House Democrats from high-tax states New Jersey and New York are still demanding that relief from a 10000 cap on deductions for state and local taxes be included if they are. The state with the largest amount of SALT deductions as a portion of AGI in 2016 was New York at 94 percent.

Senator Joe Manchin the West Virginia Democrat at the center of negotiations over an economic-policy bill said he opposes changes to the state and local tax deduction dealing a blow to House. SALT deduction New York. States that benefit most from the SALT deduction include California New York Illinois and Texas.

In 2018 Maryland was the top state at 25 percent of AGI. A group of House Democrats from New Jersey and New York vowed for years to draw a line in the sand and oppose any tax plan that didnt lift a cap on local and state tax deductions. The New Jersey Democrat has been among the lead advocates in.

House Democrats on Friday passed their 175 trillion spending package with an increase for the limit on the federal deduction for state and local taxes known as SALT. Back in 2020 the IRS promised to issue regulations that would provide more guidance on the state PTE taxes as a workaround but so far there has been no word. Learn more about the SALT Deduction a new federal tax law that caps itemized state and local tax deductions for all filers.

Kenny Holston for The New York Times. If you remember President Biden promised to eliminate the double taxation of the state and local tax deduction cap the SALT cap or at least raise it from 10000 to a higher amount. States and cities with high income taxes also tend to be high-opportunity states like California and New York.

It is likely not high on their priority list as the SALT cap expires on December 31 2025. Representatives Josh Gottheimer Tom Suozzi and Mikie Sherrill who have led efforts for months to include an increase to the 10000 cap on deductions for state and local tax or SALT said they. Its not an issue of red states versus blue states.

The cap applies to. Extended SALT Cap Quickly Replaced by Democrats 300 pm Senate Democrats have voted 51 to 50 to strip out an extension of the 10000 cap.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

Dems Don T Repeal The Salt Cap Do This Instead Itep

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

How Does The Deduction For State And Local Taxes Work Tax Policy Center

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Supreme Court Rejects Salt Limit Challenge From New York New Jersey

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Why This Tax Provision Puts Democrats In A Tough Place Time

Pro Salt House Dems Say They Ll Back Spending Plan

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep