a shock is ahead for the housing market

In the November 2021 housing forecast economists at Fannie Mae said the housing market price surge probably peaked and the market will normalize. Since the Fed is rushing to hike the US into a deep recession just so inflation will supposedly slide ahead of the November midterms in line with Bidens demands the housing market is eager to comply with Powells and Bidens handlers wishes and is leading the charge into the economic abyss as we discussed most recently here and as the latest nationwide.

The Housing Market Just Hit A Level Not Seen Since 2007

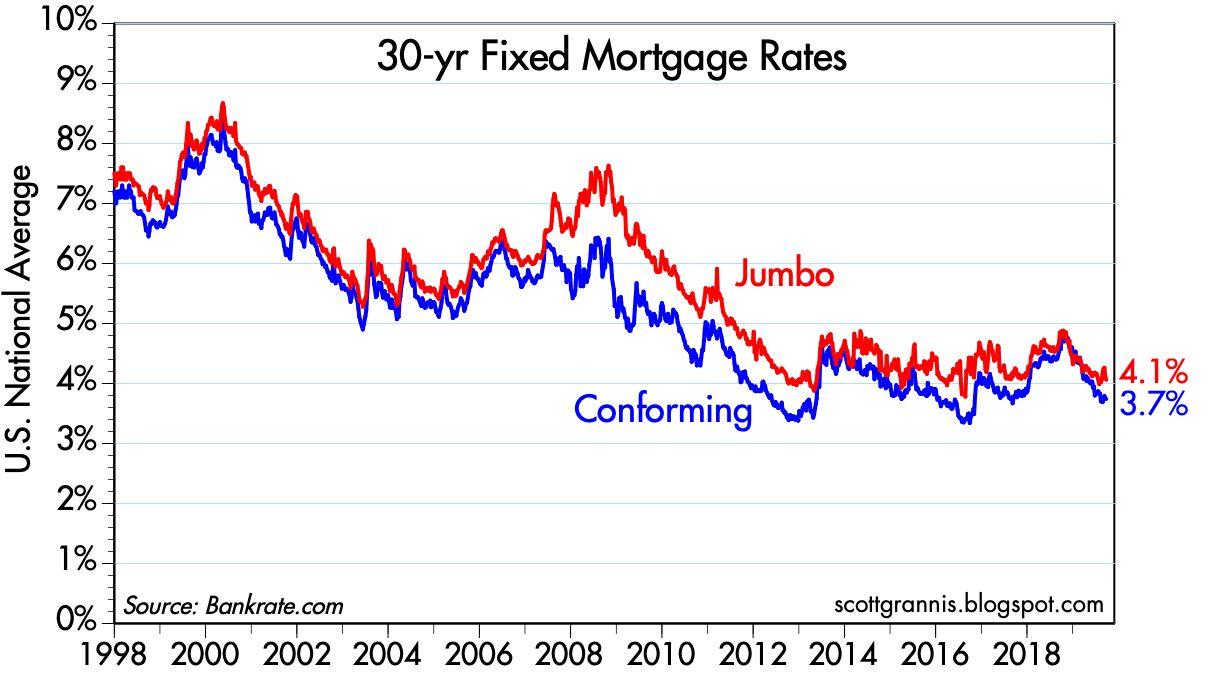

Mortgage rates will be over 6.

. Looking ahead Mark Bainey. But if a borrower got that loan at a 5 rate that payment would. So if even a small percentage of these 17 million struggling borrowers opt to sellrather than returning to.

The 10-year ARM adjustable rate mortgage was at 43. At a 311 rate a borrower would owe 1710 per month on a 400000 mortgage. Before a recent speech to 1000 people from the housing industry John Burns founder of John Burns Real Estate Consulting asked.

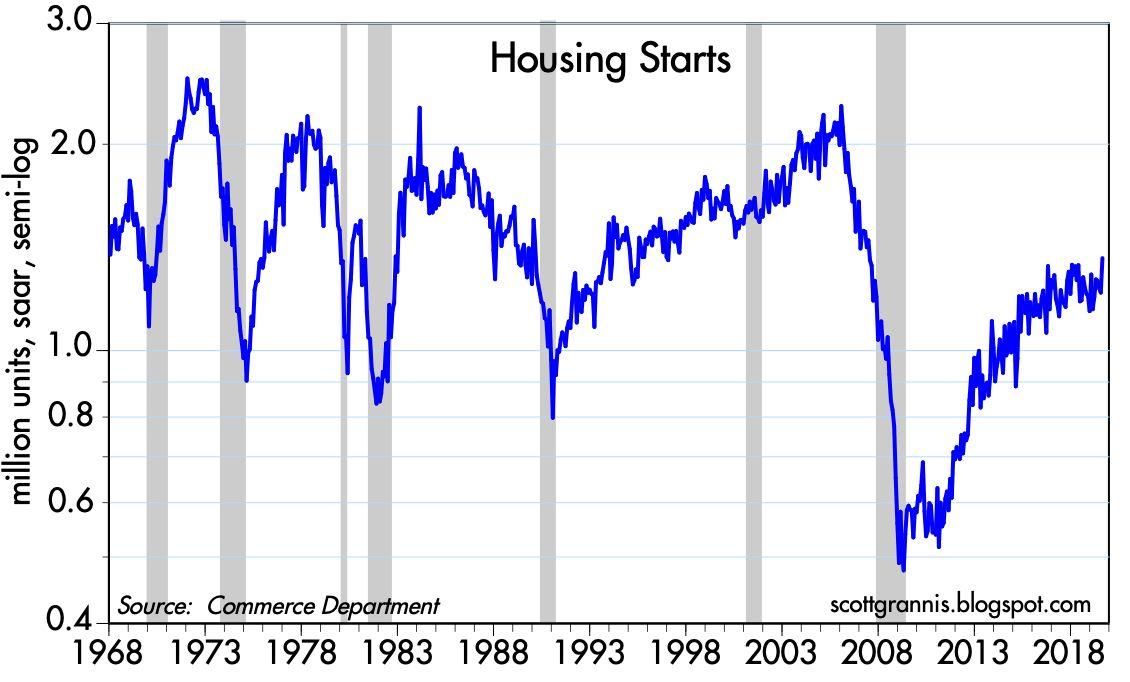

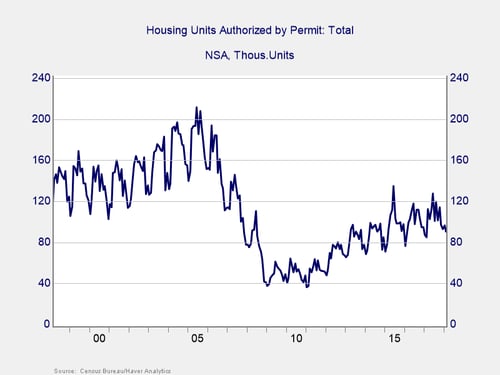

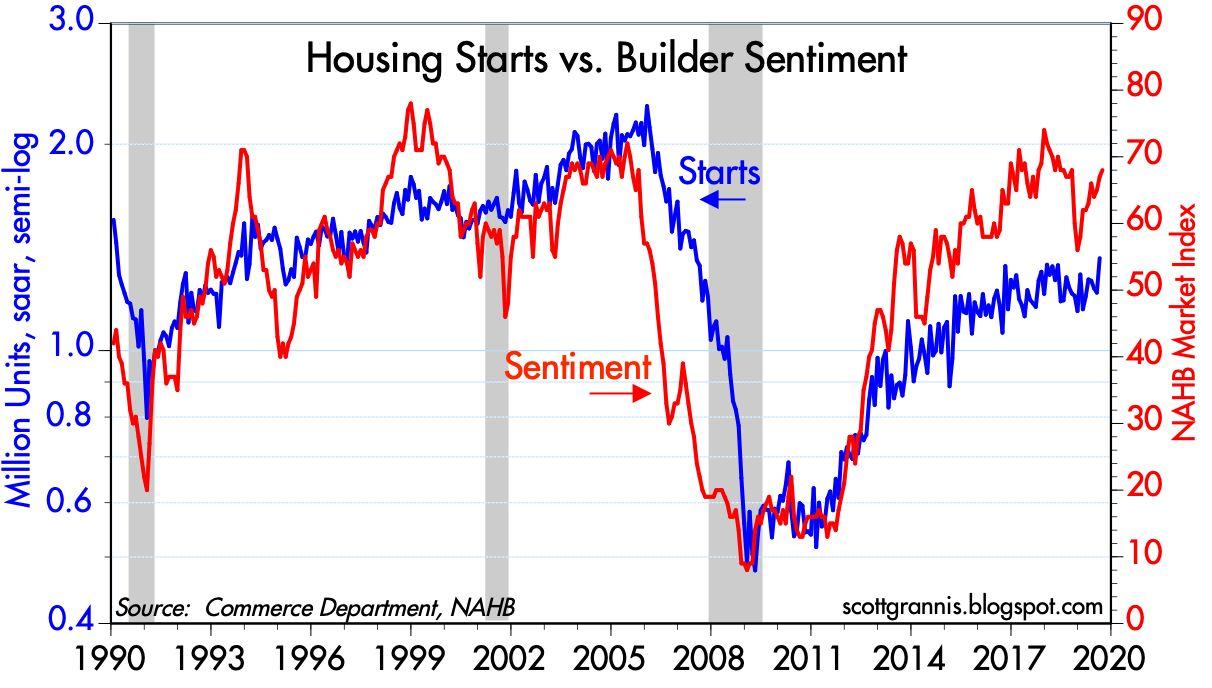

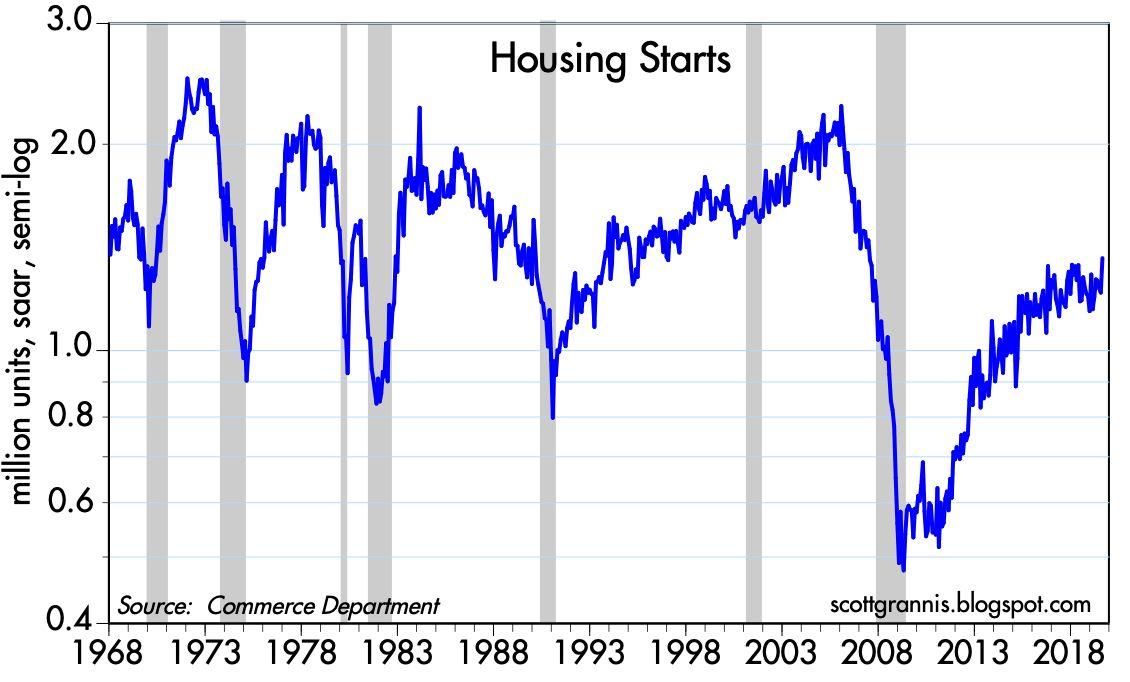

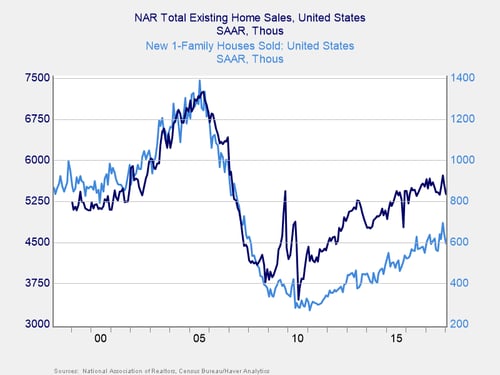

Many housing market predictions forecasted a cooling-off from the madness of 2021 but according to Fannie Mae not as fast as buyers would like or expect. Recession from March 2001-November 2001. In fact this year housing inventory hit a 40-year low.

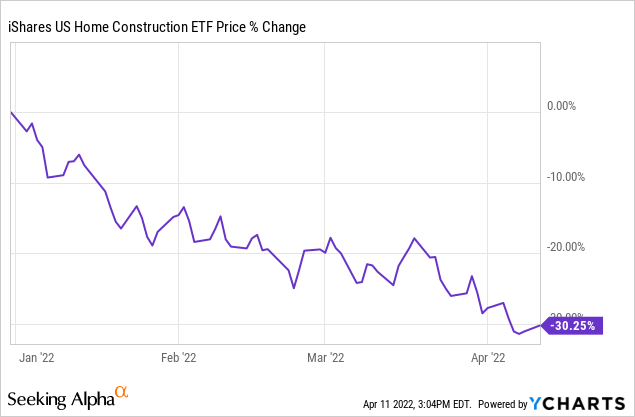

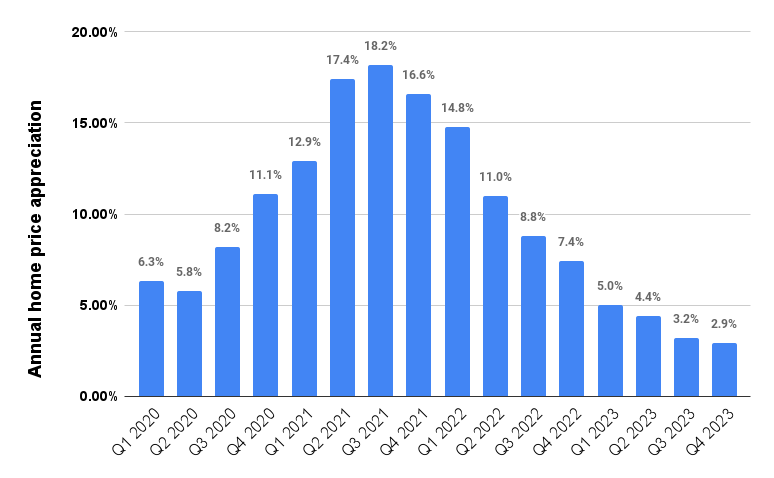

According to Freddie Macs recent housing forecast house value growth in 2022 will be less than half of what weve witnessed last year. But stress lines are beginning to show in the housing market. The question is how long will it take.

Home sales and prices even grew during the US. Meanwhile existing home prices continued to. Instead I think home prices will rise by closer to 8 in 2022 not 16 like it did in 2021.

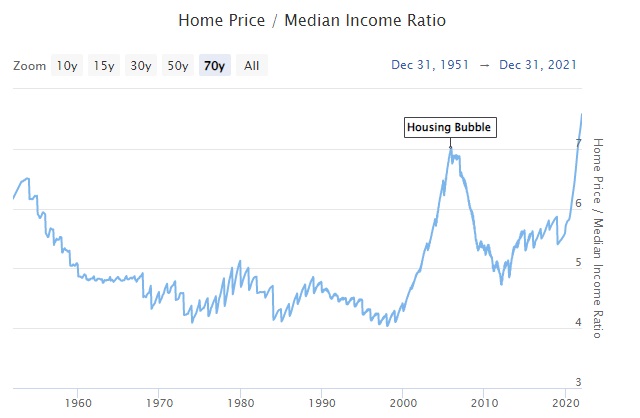

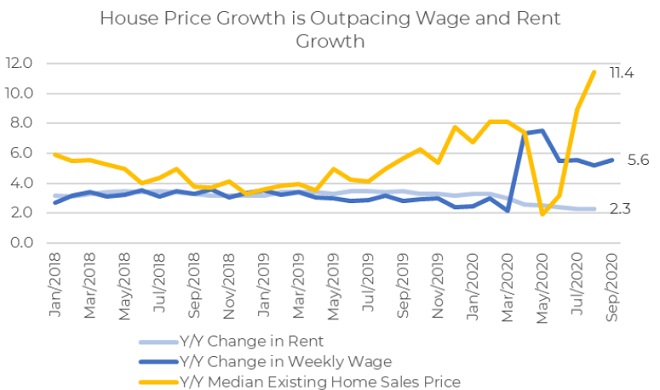

Home prices have risen so far so fast that they have become overvalued. Or buyers on a budget visiting 70 80 or even 100 properties with no luck while continually pruning their wish list for size location and features. This pace of double-digit price appreciation in the housing market is unsustainable.

A shock is headed for the housing market. A financial analyst says there could be tough times ahead for the housing market despite another upbeat set of figures regarding house prices. Thats a bigger deal than it might first appear.

Sarah Coles senior personal finance analyst at financial consultancy Hargreaves Lansdown says that the latest Office for National Statistics data shows the average UK house price at a record high after a 108 per. Yet there is reason to believe that the pool of potential homebuyers may not shrink as much as the jobless claims and unemployment rate may suggest. Nationwide house prices appear overvalued by approximately.

Home prices will remain high into 2022. The housing market is far from headed for a crash in my opinion. 2022 Housing Prediction 5.

Meanwhile house prices are high. The presentation featured a panel of industry veterans who discussed how to think ahead to and prepare for this development what macro-economic factors will influence the 2021 housing market. The median home price for single.

Implications for Todays Market and COVID-19. Surged 248 year-over-year to a median sale price of 386888 according to Redfin. In our housing market we.

As of April 13th 2022 the 30-year fixed-rate mortgage hit 5 for the first time since 2011. In June 2021 home prices across the US. The Biden-Harris administration has made it clear it has no plans for another extension of the mortgage forbearance program which is set to lapse on Sept.

Housing market has proven to be incredibly resilient in the face of recent pandemics and the economic shock that followed the 911 terrorist attacks. In fact the indicators discussed here give reason to be optimistic about the long-term outlook for residential real estate. New builds sold for 30000 40000 60000 over a month-old spec before the foundation is even laid.

While the housing market might start to see small shocks ahead with the forbearance program ending next month lenders have strict guidelines they are required to follow and a sharp increase in foreclosures does not appear to be likely. Home prices spiked by 259 in Phoenix 247 in San Diego and 234 in Seattle according to the report. In many ways the rise and fall of major stock indexes can trigger a variety of actions and behaviors that can indirectly affect the way people choose to buy and sell their homes.

As a result there are more. The pandemic was the worst thing ever to happen. Heres the facts that frame how the market got so wild and what we can expect to see in.

With demand showing no signs of cooling and record-low inventory I expect home prices to remain high into next year. Opening the economy is going to be very educational for recent first-time home buyers. Bond-tapering and Fed rate hikes started on March 16 2022.

And it will be a shock for them to experience multiple interest rate rises. It shows that home prices increased by 113 percent in 2020 and 159 percent in 2021 as a result of robust housing demand and record low mortgage rates. Economic hardship particularly a negative income shock and high unemployment can diminish the number of potential homebuyers in the market Kushi said.

Affordability is becoming an issue.

A Clear Warning Signal For The Housing Market Seeking Alpha

Is The Housing Market Rolling Over

The Housing Market Could Crash In 2023 Propertyonion

The Housing Market Just Hit A Level Not Seen Since 2007

A Shock Is Headed For The Housing Market

Robert Shiller Says The Housing Market Will Crash No One Else Seems To Think So Seeking Alpha

No Housing Market Bubble Seeking Alpha

California Housing Crash Searches Surge

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

No Housing Market Bubble Seeking Alpha

Pin On Real Estate And Mortgage News

Is The Housing Market Rolling Over

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

Real Estate Housing Market Crash Housing Bubble Factors Signals Predictions

Why Despite The Coronavirus Pandemic House Prices Continue To Rise The Economist

The Unassuming Economist House Prices In New Zealand

Either Zillow Is Broken Or We Re In A Massive Housing Bubble